EastWest Bank Personal Loan Updated on September 2024

When you get a loan, what do you actually check first?

When Filipinos search for a personal loan, what influences their decisions? Some will check eligibility first. Others will, of course, check if their needs can be met. Banks create personal loans, including the EastWest Bank Personal Loan.

When you decide to get a loan, you first need to check if you qualify for it. For example, banks and legal money lending companies may have specific requirements like age, income level, or employment status. They might only approve personal loans to people with stable jobs. So, before you even consider applying, you should ensure you meet all these conditions. If you don’t, you might waste time processing a personal loan you can’t get.

For many Filipinos, checking their eligibility is one of the first steps. However, they also consider whether the loan meets their needs. Often, they ask themselves, “How much money do I need?” or “Can I pay this back on time without too much trouble?” EastWest Bank offers personal loans designed to help with different situations, such as medical emergencies, home repairs, or education.

Other Pinoys consider things like interest rates and loan terms. A longer repayment term might mean smaller payments each month, but it could also mean paying more interest over time.

EastWest Bank personal loans are transparent about eligibility, loanable amount, and repayment terms. If you are considering applying, you must consider these key factors that will help you make the right choice.

EastWest Bank Personal Loan Eligibility

EastWest Bank offers personal loans to Filipinos ages 21 (at the time of application) to 65 (upon loan maturity).

But can every Filipino qualify for one?

Yes. If you are a foreign national permanently living in the Philippines, you can apply for an EastWest Bank personal loan.

Furthermore, to apply for this EastWest loan, your annual income must be Php 180,000 or at least Php 15,000 monthly.

In addition, you must have a landline number, either a home or business phone. You may prefer the personal landline number to keep your privacy if you have both.

EastWest Bank Personal Loan Requirements

Aside from the eligibility, you must also have the required documents. Note that the length of your EastWest Bank loan process will depend on how soon you can provide the complete documents. The bank will use this paperwork further to assess your identity, creditworthiness, and financial status.

Like most banks, the requirements vary depending on your employment status. Employed applications or professionals must prepare at least one or two valid government IDs, the most recent proof of billing, the latest payslip, BIR FORM 2316/W2, the statement account of your credit card, and the original Certificate of Employment (COE). Most importantly, submit an accurate filled-out EastWest bank loan application form.

Meanwhile, self-employed applicants must present a photocopy of the latest ITR/BIR Form 1701 and Audited Financial Statements, an SEC Registration Certificate or DTI Registration Certificate, and a valid account or credit card reference statement.

Since foreign nationals are eligible, they must have proof of residence in addition to the paperwork mentioned above. This can be the Alien Certificate of Registration, Immigrant Certificate of Registration, or a Photocopy of the Resident Visa stamp on their Passport.

Upon compiling the said documents, prepare clear photocopies. Also, do not forget to check the details to ensure they are all accurate and consistent. Your loan process will take more time if the bank notices any discrepancies in the information.

EastWest Bank Personal Loan Interest Rate

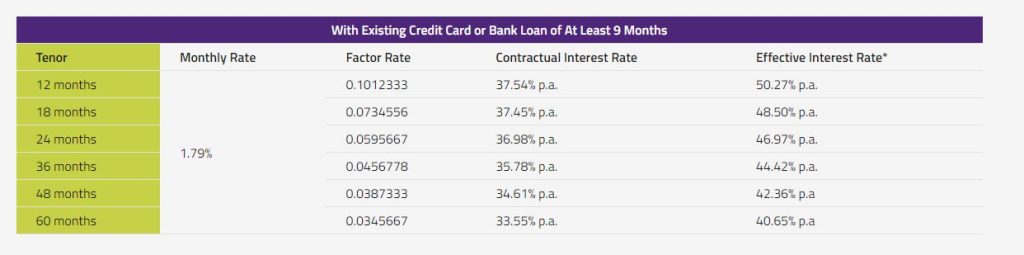

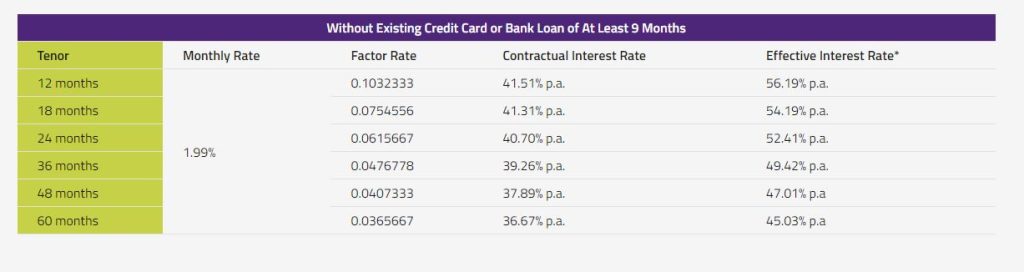

Credit cardholders who have been with EastWest for at least a year can enjoy lower interest rates. The monthly existing EastWest interest rate is at 1.79%, while the Effective Interest Rate per year is 40.65% to 50.27%.

In case you do not have a credit card or your East West credit card is less than 12 months old, you will have a monthly EastWest interest rate of 1.99%. Your Effective Interest Rate ranges from 45.03% annually to 56.19%. With those non-cardholders, the shorter the term, the higher the interest rate.

Make sure you choose the correct loan term that fits your financial standing. An EastWest personal loan can be as short as 12 months up to 60 months. At the same time, it is tempting to get the longer term as it may have lower amortization. Note that some banks and licensed money lenders may not quickly approve new loans if you have existing loans and other financial responsibilities.

EastWest Loanable Amount

EastWest Bank offers a personal loan with a minimum amount of Php 25,000 up to Php 3,000,000. While you may request a loan amount, it will still depend on the bank’s discretion. With the help of your documents and by accessing your credit report, which is recorded in credit bureaus, the bank will evaluate your capacity and behavior during payment.

Understand that though EastWest loans are known to have interest rates, you must be ready to pay the processing fee of Php 1,900. It will be deducted from your loan proceeds once you avail the loan. Also, every loan application charges a documentary stamp worth Php 1.00 for every Php 200.00 of the approved loan amount or a fraction of PNs greater than Php 250,000.

Furthermore, EastWest Bank’s processing time is about 5 to 7 banking days. The bank needs this time to review your documents, ensure your eligibility, and decide whether to approve your loan.

Once the EastWest approves your loan, getting the money will take you longer. If you choose to pick up the money in person, you might need to wait another 2 banking days. If you prefer to have the money delivered or a direct bank account deposit, it could take 2 to 4 more banking days. As a result, it could take about 7 to 11 banking days from when you apply. But still, it depends on how you receive the disbursed cash loan.

EastWest Bank Personal Loan Calculator

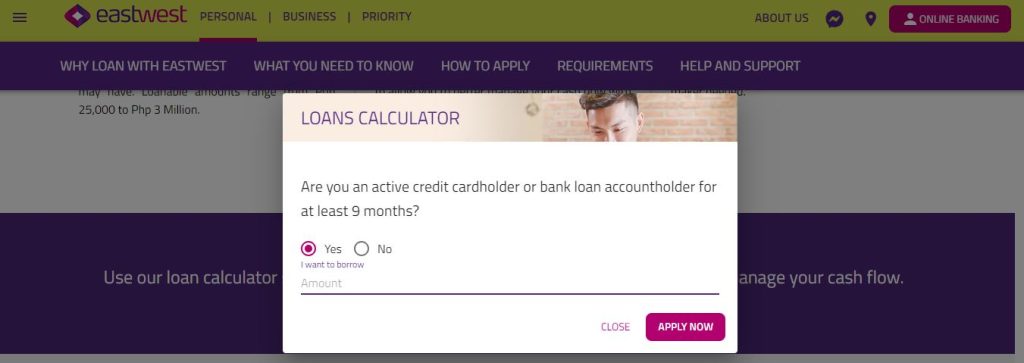

EastWest Bank loan calculator helps you manage your finances more. It steers you away from building debts. So you are secure that the loan amount you’ll borrow is within your capacity to repay.

With the EastWest Bank calculator, you must identify if you’ve been an active credit card holder or bank loan account holder for at least 9 months. Then, you need to enter the amount you want to borrow. Afterward, choose which term (12, 18, 24, 36, 48, or 60). From here, you can view the monthly installments you must pay. Once you have seen and understood this, you can decide whether to apply for an EastWest Bank Personal Loan.

However, you will notice a minimal difference in the monthly installments. Active EastWest credit card and bank account holders have lower monthly repayments than new credit card owners. That’s one benefit of having a personal account with EastWest Bank.

Please note that the estimated installments are subject to change. Your actual monthly installment will be reflected on your Promissory Note and Disclosure Statement (PNDS).

Benefits of EastWest Bank Personal Loan

Of course, when taking out a loan, you will analyze its benefits. With an EastWest personal loan, you can use the instant cash loan however you want. Whether for a dream vacation, paying for school tuition, or buying the latest smartphone, the choice is yours. You have the freedom to decide how to spend the money.

Another great benefit is that this loan is unsecured. It means you don’t have to offer any of your belongings, like your car or house, as collateral. You don’t risk losing anything if you can’t repay the loan.

Plus, EastWest Bank doesn’t require a co-maker. A co-maker agrees to repay the loan if you can’t, so not needing one makes things much easier for you. It saves you from straining any close relationship due to your debts.

Once your loan is approved, getting quick loan cash is also convenient. You can pick it up at the bank’s head office or, if you prefer, directly send funds to your bank account. This makes it simple and fast to access your funds without too much hassle.

These benefits make the EastWest Bank Personal Loan a flexible and easy option for anyone needing extra quick cash.

Downsides of EastWest Bank Personal Loan

There are a few downsides to the EastWest Personal Loan that you should know about. If you are looking for a quick cash loan due to emergency needs, this might not be appropriate. EastWest loans usually take about a week to approve, which might be too long if you need cash immediately.

Another reason it may not fit you is the need for a landline number. In today’s world, many people do not have a landline. Unless you have an internet subscription with a telco or own a business, you won’t have any reason to have a landline. Sure, you can register your company’s phone number, but make sure you are willing to let your company know you are applying for a loan. It could be uncomfortable if you want to keep it private.

There is also the issue of interest rates. If you do not own a credit card, you will lose the chance to have lower interest rates. Credit cards assure EastWest Bank that you have a credit record, and they can easily track your financial status, the way you spend, and your payment behavior. They look at your payment history to decide how risky it is to lend to you. If you are delinquent with your credit card bill payments, you will have difficulty getting approved.

These downsides are crucial when deciding if an EastWest Bank Personal Loan is right for you.

EastWest Bank Personal Loan Contact Number

If you are indeed interested in getting an EastWest loan, get your inquiry to the bank first. You may contact EastWest Bank through the following:

- 24 Hour Customer Service (632) 888-1700

- Email Service csloans@eastwestbanker.com

How to Apply for an EastWest Personal Loan?

After thoroughly understanding how an EastWest Bank personal loan works, you finalized your decision to apply. Here’s what you should do.

Step 1. Start by filling out the application form. This form will ask for basic details like your name, address, job, and loan amount you wish to borrow. Make sure you read through all the terms and conditions carefully.

Step 2. Gather any additional documents that you need to support your application. It includes your ID copy, proof of your income, and proof of residence for foreigners. Make sure you scan these documents clearly so the bank can easily read them.

Step 3. Submit the application form along with the scanned documents. Then, you’ll need to wait for the bank to confirm that they received your application. After that, it’s just a matter of waiting for their decision. They will check your information, and if everything looks good, they will approve your loan. If not, inquire about the reason for your loan rejection.

By following these steps, you can apply for a personal loan and get closer to getting the fast cash you need. But If you are looking for a personal loan with flexible terms and payment methods, you can apply at Cash Mart. Cash Mart offers loan products disbursed directly to your bank account within a day. Visit CashMart.ph to apply now.

Frequently Asked Questions

How can I receive the disbursed cash loan from EastWest?

As stated earlier, you can request your loan cash disbursement in different ways: in person, by delivery, or by credit to an account.

When your loan is ready to be released, you must present the original copies of the submitted documents. In addition, you must have two valid IDs: one for the EastWest Personal Loan Releasing Unit to verify your identity and another for the lobby guard of the building. Bring the original signed application form, and make sure you have post-dated checks (PDCs) that are fully filled out and signed. Be careful that these checks do not have any erasures, corrections, or alterations.

For the delivery and credit to account option, you need a photocopy of one valid ID, which you submitted during your initial application, with three specimen signatures. In addition, you should present the original copies of the documents you submitted earlier. No worries. These only need to be presented, not submitted. Additionally, you must provide post-dated checks (PDCs) that are fully filled out and signed, ensuring there are no erasures, corrections, or alterations on the checks.

What if I fail to repay my monthly installments?

If you make an EastWest Bank personal loan payment late, the bank will charge a penalty. This penalty is 8% of the amount you owe or Php 500, whichever is higher.

For example, if your borrowed amount is small, you will still have to pay at least Php 500. But if 8% of your loan amount is over Php 500, you will pay that value instead. This fee will be added every month you are late with your payment. It’s essential to pay on time to avoid these extra charges.

Can I repay my EastWest Bank personal loan in advance?

Yes, you can pay off your loan early if you want to. However, there is a fee for making early payments. This fee is 8% of the amount you still owe or Php 500, whichever is higher.

For example, if 8% of your remaining balance is less than Php 500, you’ll pay Php 500. But if 8% of your remaining balance is more than ₱500, you’ll pay that amount. So, knowing this fee is essential before deciding to pay off your loan early.